What Is ACH Merchant Processing? Benefits, Costs, and How to Get Started

Introduction

Looking for a more cost-effective way to accept customer payments? ACH merchant processing might be your answer. In 2025, businesses are embracing ACH payments as a secure, reliable, and low-fee alternative to credit card transactions. In this guide, we’ll break down what ACH merchant processing is, its key benefits, typical costs, and how to set it up for your business — so you can save money and streamline operations.

What Is ACH Merchant Processing?

ACH stands for Automated Clearing House — a U.S. financial network that moves money electronically between bank accounts. Governed by Nacha, the ACH system processes billions of transactions annually, ranging from direct deposits and bill payments to business-to-business transfers.

There are two main ACH types:

ACH Credit: Funds are “pushed” from the payer’s bank account to the recipient.

ACH Debit: Funds are “pulled” from the customer’s bank account with authorization.

ACH merchant processing allows your business to accept these payments directly, cutting out costly credit card fees and ensuring a smoother cash flow process.

Benefits of ACH Merchant Processing

Lower Transaction Fees

While credit card payments often cost 1.5%–3.5% + $0.30 per transaction, ACH fees usually range from 0.2%–1.5% or a flat $0.20–$1.50.

💡 Example: On a $500 transaction, ACH might cost $0.60, while a credit card could cost $12.74.

Predictable Cash Flow

ACH payments reduce payment declines caused by expired cards and can be automated for recurring billing — making it ideal for memberships, subscriptions, and invoicing.

Streamlined Operations

From payroll to supplier payments, ACH eliminates the hassle of paper checks and manual deposits, saving time and administrative costs.

Enhanced Security

Since funds move bank-to-bank with fewer intermediaries, there’s less exposure to fraud compared to card-based payments.

Costs Associated with ACH Merchant Processing

Per-Transaction Fees

ACH fees typically range from $0.20–$1.50 or 0.5%–1.5% of the transaction amount. Some processors (like Stripe) cap ACH fees at $5.

Additional Fees

Return/NSF fees: $2–$5

Chargeback fees: $5–$25

Monthly fees: $5–$30 depending on provider

Same-Day ACH

Same-day ACH offers faster processing but may include slightly higher fees.

How to Get Started with ACH Merchant Processing

1. Choose a Payment Processor

Look for providers offering competitive rates, strong security, and easy integration. A great place to start is MerchaMax Payment Processing — they offer tailored solutions for businesses of all sizes.

2. Set Up and Verify Your Bank Account

Most processors verify bank accounts with micro-deposits for security.

3. Integrate ACH Payments Into Your Workflow

Embed ACH into your online checkout, invoices, or subscription systems.

4. Configure Recurring Billing

Automate repeat payments to reduce missed transactions and administrative work.

5. Monitor Transactions Regularly

Track payments, manage returns, and respond quickly to any issues.

ACH vs Other Payment Methods

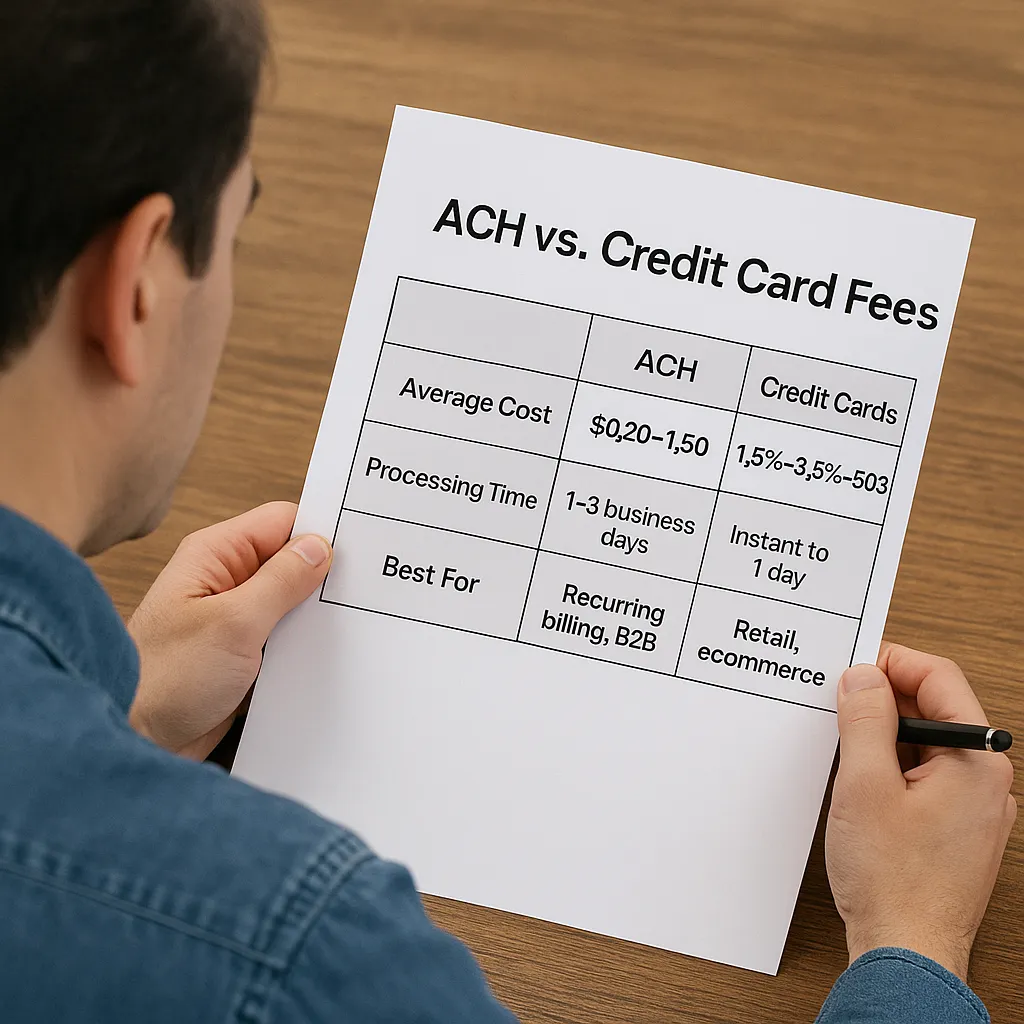

FeatureACH ProcessingCredit CardsWire TransfersAverage Cost$0.20–$1.501.5%–3.5% + $0.30$15–$50+Processing Time1–3 business daysInstant to 1 daySame dayBest ForRecurring billing, B2BRetail, ecommerceLarge international

Conclusion

ACH merchant processing is a cost-effective, secure, and scalable payment solution for businesses in 2025. By switching from high-fee credit card transactions to ACH, you can boost your margins, improve cash flow, and simplify your payment operations.

If you’re ready to get started, check out MerchaMax Payment Processing to explore tailored solutions that fit your business needs.

FAQs

What does ACH stand for?

Automated Clearing House, a U.S. network for moving money electronically between banks.

How long does ACH take?

Standard ACH takes 1–3 business days; same-day ACH processes faster.

Is ACH secure?

Yes — ACH is governed by Nacha rules and uses bank-level encryption for transactions.